8 significant events occurred in the past 24 hours.

Bitcoin SV airdrop claims explained

2024-08-15 11:30:30 EDT, Sentiment: 0.69

Bitcoin SV airdrop details and the new ‘permissionless’ version of BitVM2 for Bitcoin sidechains are highlighted.

Bitcoin SV Airdrop: How to Claim Your Free Tokens Today

Summary: The article details the tax implications of receiving Bitcoin SV airdrops, emphasizing that airdropped tokens are considered taxable income, with reporting required. It also notes that selling these tokens may trigger capital gains tax and advises maintaining detailed records and seeking professional tax advice.

- Sentiment: 0.0

- Medium @ 2024-08-15 11:30:30 EDT Read More

LiFi integrates ThorChain for seamless Bitcoin swaps across EVM chains

Summary: LI.FI has integrated support for native Bitcoin swaps via ThorChain, enhancing Bitcoin transfers between Ethereum Virtual Machine (EVM) chains and simplifying exchanges with other cryptocurrencies. This integration aims to boost Bitcoin access and DeFi adoption.

- Sentiment: 0.6

- CryptoSlate @ 2024-08-15 20:30:22 EDT Read More

The Science Behind Bitcoin SV Airdrops: What Makes Them Tick

Summary: The article provides a guide on using MetaMask to claim Bitcoin SV airdrops, including setting up the wallet, connecting it to the airdrop platform, and authorizing transactions to receive tokens.

- Sentiment: 0.0

- Medium @ 2024-08-15 20:26:25 EDT Read More

Bitcoin sidechain creators tout new ‘permissionless’ version BitVM2

Summary: The latest update on the Bitcoin Virtual Machine (BitVM) introduces BitVM2 and the BitVM Bridge, featuring major improvements like a permissionless challenge system, enhancing Bitcoin’s scalability and off-chain smart contract capabilities without altering Bitcoin’s core rules.

- Sentiment: 0.6

- Cointelegraph @ 2024-08-15 21:54:56 EDT Read More

Bitcoin sidechain creators tout new ‘permissionless’ version BitVM2

Summary: The article details the release of BitVM2, an advanced Bitcoin scaling solution that improves transaction efficiency and challenge processes. BitVM2 introduces a more accessible, permissionless system and enhances the BitVM Bridge for better rollup functionality on Bitcoin.

- Sentiment: 0.6

- CoinTelegraph @ 2024-08-15 21:54:56 EDT Read More

MicroStrategy leveraged Bitcoin ETF approved.

2024-08-15 09:58:55 EDT, Sentiment: 0.8

MicroStrategy’s leveraged Bitcoin ETF has been approved and launched in the U.S., offering 175% exposure to Bitcoin.

Breaking: MicroStrategy ETF Receives Green Light for Leveraged Bitcoin Exposure

Summary: The SEC has approved MicroStrategy’s leveraged ETF, MSTX, which aims to provide 175% of MicroStrategy’s daily stock returns. Given MicroStrategy’s substantial Bitcoin holdings, MSTX offers indirect but amplified exposure to Bitcoin, reflecting a regulatory shift towards such ETFs.

- Sentiment: 0.7

- Coingape @ 2024-08-15 10:07:07 EDT Read More

Leveraged MicroStrategy ETF debuts in the US

Summary: Defiance's newly launched MSTX ETF, linked to MicroStrategy’s leveraged shares, offers indirect Bitcoin exposure through MicroStrategy's significant BTC holdings. This ETF is the most volatile in the US market but remains less volatile compared to its European counterpart.

- Sentiment: 0.1

- Crypto Briefing @ 2024-08-15 09:58:55 EDT Read More

US Debuts First Leveraged MicroStrategy ETF to Amplify Bitcoin Exposure

Summary: The MSTX ETF, approved by the SEC, aims to amplify Bitcoin exposure through leveraged investments in MicroStrategy stock. This ETF reflects the increasing institutional interest in Bitcoin and represents a novel way to gain amplified Bitcoin exposure via a single stock.

- Sentiment: 0.6

- cryptonews @ 2024-08-15 11:30:55 EDT Read More

SEC Approves First Ever Bitcoin Leveraged ETF by MicroStrategy

Summary: The SEC has approved MSTX, a leveraged ETF focused on MicroStrategy, a major Bitcoin holder. MSTX amplifies MicroStrategy’s stock movements by 175%, offering investors a more aggressive way to gain exposure to Bitcoin through the company's substantial holdings.

- Sentiment: 0.7

- CryptoNewsZ @ 2024-08-15 12:30:55 EDT Read More

SEC Greenlights Crypto-Linked Leveraged MicroStrategy ETF

Summary: The SEC has approved MSTX, a leveraged ETF based on MicroStrategy, which holds significant Bitcoin assets. This ETF offers 175% leverage on MicroStrategy’s daily returns, providing investors a high-risk, high-reward way to gain exposure to Bitcoin through traditional equity investments.

- Sentiment: 0.3

- cryptonewsz @ 2024-08-15 12:02:44 EDT Read More

MicroStrategy ETF Launches in the U.S., Offering 175% Leveraged Bitcoin Exposure

Summary: The MSTX ETF, launched in the U.S., offers 175% daily leveraged exposure to MicroStrategy's Bitcoin holdings, catering to sophisticated investors. This high-risk fund amplifies Bitcoin exposure through MicroStrategy’s stock, which has significantly outperformed most S&P 500 companies.

- Sentiment: 0.8

- CoinChapter @ 2024-08-15 20:12:12 EDT Read More

$590M Bitcoin Transfer to Coinbase

2024-08-15 02:00:00 EDT, Sentiment: 0.47

The U.S. government transferred $590 million worth of Bitcoin from Silk Road to Coinbase.

U.S. Government Transfers $594 Million Silk Road Bitcoin to Coinbase

Summary: The U.S. government transferred $593.5 million worth of Bitcoin (10,000 BTC) to Coinbase Prime on August 14, causing a 3.6% price drop. This move, part of a broader liquidation trend, sparked market volatility and speculation about upcoming elections.

- Sentiment: -0.3

- Coinatory @ 2024-08-15 02:00:00 EDT Read More

US $590M Bitcoin Transfer to Coinbase: Why Sale Is Unlikely, Analysts Reveal

Summary: The US government has transferred 10,000 Bitcoin, valued at $590 million, to Coinbase. Analysts suggest this transfer is unlikely to lead to selling pressure, as the Bitcoin might be held securely rather than sold, minimizing market impact.

- Sentiment: 0.1

- EconoTimes @ 2024-08-15 12:13:22 EDT Read More

US $590M Bitcoin Transfer to Coinbase: Why Sale Is Unlikely, Analysts Reveal

Summary: The US government recently transferred 10,000 Bitcoin, worth approximately $590 million, to Coinbase. Analysts suggest this move is unlikely to cause selling pressure, as the Bitcoin may be held for safekeeping rather than immediate sale.

- Sentiment: 0.2

- EconoTimes @ 2024-08-15 12:13:22 EDT Read More

Leawood police recover $19K in cryptocurrency scam after victim deceived by 'bitcoin ATM'

Summary: Leawood police recovered over $19,000 for a cryptocurrency scam victim who was deceived into using a "Bitcoin ATM." The department has reclaimed over $1 million from similar scams and advises caution against high-return promises and suspicious electronic messages.

- Sentiment: 0.5

- KMBC Kansas City @ 2024-08-15 16:10:00 EDT Read More

Bitcoin Scam Tricks US Residents with Fake Warrants

Summary: A Bitcoin scam in Montgomery County, Pennsylvania, involves fake emails claiming to be from government authorities. These emails falsely demand Bitcoin payments for supposed arrest warrants, causing significant alarm. Officials warn that legitimate authorities never request Bitcoin payments.

- Sentiment: -0.8

- deythere @ 2024-08-15 13:07:47 EDT Read More

Bitcoin ETF outflows hit $81M.

2024-08-15 00:22:05 EDT, Sentiment: 0.59

US spot Bitcoin ETFs experienced an $81 million outflow, ending a two-day positive flow streak.

Significant Outflows in US Bitcoin ETFs on August 14

Summary: On August 14, US Bitcoin ETFs faced a significant outflow of $81 million, with Grayscale's GBTC seeing its outflow double. This reversed the positive trend observed over the previous days. Ethereum ETFs, however, recorded an $11 million inflow.

- Sentiment: -0.7

- Blockchain News @ 2024-08-15 00:22:05 EDT Read More

Institutional Investors Show ‘Diamond Hands’ as Spot Bitcoin ETF Adoption Grows in Q2, Reports Bitwise CIO

Summary: Matt Hougan's August 14 analysis highlights a 30% increase in institutional involvement with spot Bitcoin ETFs in Q2, despite a Bitcoin price downturn. Institutions showed resilience, with 44% increasing their positions, indicating strong long-term commitment and growing diversity in Bitcoin ETF investors.

- Sentiment: 0.7

- CryptoGlobe @ 2024-08-15 01:54:25 EDT Read More

Norway's Wealth Fund Bets On Bitcoin: Analyst Discloses Over 100% Increase In BTC Holdings |

Summary: Norway’s sovereign wealth fund, Norges Bank Investment Management, has indirectly accumulated 2,446 BTC, a notable increase. This rise is linked to the fund’s investments in Bitcoin-related firms, reflecting Bitcoin’s growing role in traditional financial portfolios and its increasing adoption.

- Sentiment: 0.6

- Bitcoinist @ 2024-08-15 02:00:19 EDT Read More

Spot bitcoin ETFs see $81 million exit, ending two-day positive flow streak

Summary: On Wednesday, U.S. spot bitcoin ETFs experienced $81.36 million in outflows, ending a brief period of positive flows. BlackRock’s IBIT and Franklin’s EZBC were the only funds to see inflows, while Grayscale’s GBTC faced significant outflows.

- Sentiment: 0.1

- The Block @ 2024-08-15 01:43:05 EDT Read More

Institutional filings surge into Bitcoin mining stocks and MicroStrategy

Summary: Recent 13-F filings revealed increased institutional investments in Bitcoin-related assets. Notable purchases include substantial shares in TeraWulf Inc by Soros Capital and the Bank of Montreal’s investment in Iris Energy, alongside significant stakes in MicroStrategy by major institutions.

- Sentiment: 0.2

- CryptoSlate @ 2024-08-15 10:15:55 EDT Read More

BlackRock overtakes Grayscale as largest crypto fund manager

Summary: BlackRock’s IBIT Bitcoin ETF has surged to $21 billion AUM, surpassing Grayscale’s GBTC, which has fallen to $14.2 billion. This shift underscores BlackRock's dominance in the Bitcoin ETF market, contrasting with Grayscale’s struggles.

- Sentiment: 0.3

- Crypto Briefing @ 2024-08-15 10:49:44 EDT Read More

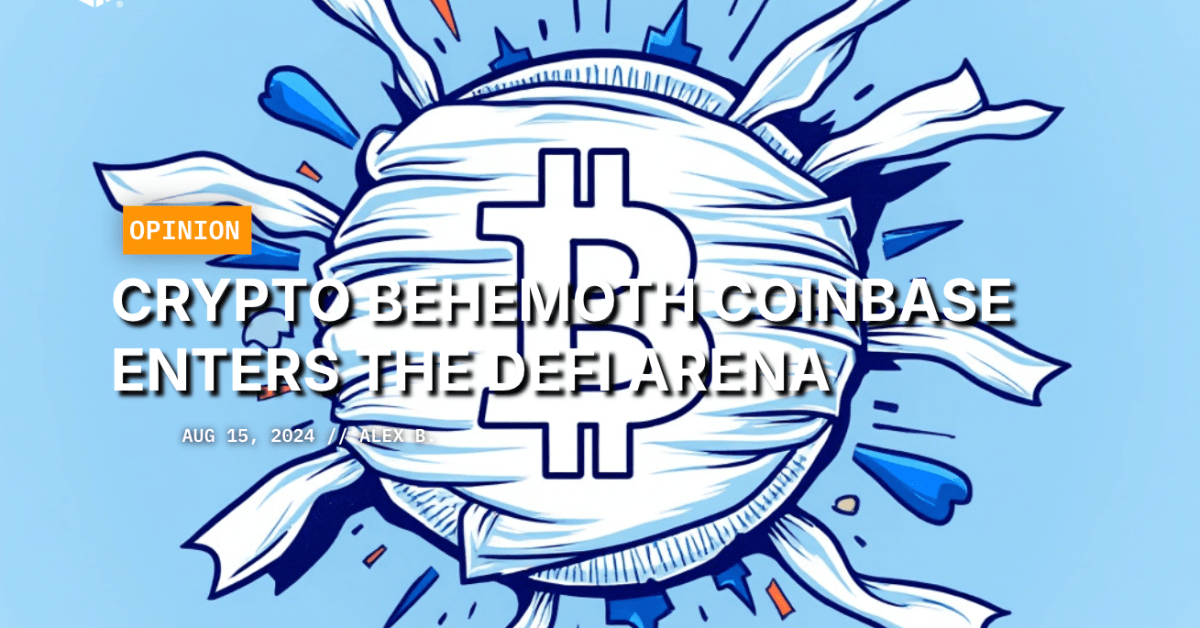

Crypto Behemoth Coinbase Enters The Bitcoin DeFi Arena

Summary: Coinbase's recent announcement to enter the wrapped Bitcoin market has sparked significant industry interest. The move aims to capitalize on the current controversies surrounding BitGo's wBTC, potentially revitalizing Bitcoin DeFi products and strengthening Coinbase's position in the Bitcoin ecosystem.

- Sentiment: 0.6

- Bitcoin Magazine @ 2024-08-15 11:13:07 EDT Read More

MicroStrategy leveraged ETF gets SEC greenlight, what’s next

Summary: Bitcoin, Ethereum, and XRP are trading below key levels after Bitcoin Spot ETFs experienced net outflows on Wednesday. Bitcoin is currently trading under $60,000, with market momentum showing some resistance and underlying positive trends despite the outflows.

- Sentiment: 0.2

- Head Topics @ 2024-08-15 11:33:00 EDT Read More

Bitcoin ETFs See $81M Outflow as Ethereum ETFs Cash In

Summary: On Wednesday, U.S. spot bitcoin ETFs saw an outflow of $81.36 million, while spot ethereum ETFs experienced a brighter day.

- Sentiment: 0.0

- Bitcoin.com News @ 2024-08-15 12:30:10 EDT Read More

Significant Outflows in Bitcoin and Ethereum ETFs on August 15

Summary: On August 15, Bitcoin ETFs saw significant outflows, with a total of 1,316 BTC, valued at $78.32 million, being withdrawn. Grayscale's Bitcoin Trust alone experienced an outflow of 480 BTC, highlighting a notable reduction in holdings.

- Sentiment: -0.4

- Blockchain News @ 2024-08-15 12:17:10 EDT Read More

Morgan Stanley reveals $187 million position in spot Bitcoin ETF

Summary: Morgan Stanley has announced managing a $190 million Bitcoin spot ETF, IBIT, under SEC notification. This positions it as the fifth-largest holder of IBIT shares, having recently sold almost all of its Grayscale ETF holdings.

- Sentiment: 0.2

- Uzmancoin @ 2024-08-15 05:05:50 EDT Read More

U.S. Spot Bitcoin ETF HODLers rise 30% despite BTC’s Q2 dip

Summary: In Q2, institutional investors, including Morgan Stanley and Goldman Sachs, increased their holdings in US spot BTC ETFs despite Bitcoin's price drop. The number of ETF holders grew by 30%, signaling sustained institutional interest in Bitcoin ETFs.

- Sentiment: 0.7

- AMBCrypto @ 2024-08-15 12:00:55 EDT Read More

More Hedge Funds Buy Bitcoin ETFs as Institutional Demand Grows

Summary: Hedge funds, pensions, and banks have increasingly invested in Bitcoin ETFs, with significant net inflows this year, despite Bitcoin's recent price drop. The rise in Bitcoin ETF holders reflects growing mainstream adoption, with notable players including Millennium Management and BlackRock's iShares Bitcoin Trust.

- Sentiment: 0.6

- BNN Bloomberg @ 2024-08-15 12:02:10 EDT Read More

Bitcoin ETF Inflows Stumble While BlackRock’s Dominance Grows

Summary: Recent data shows a brief pause in Bitcoin ETF inflows, with $81.4 million in outflows on August 14. Despite this, BlackRock’s Bitcoin ETF remains strong, leading with $22 billion in assets. This highlights Bitcoin ETF volatility and investor sentiment shifts.

- Sentiment: 0.2

- DailyCoin @ 2024-08-15 12:00:00 EDT Read More

Majority of Institutional Investors Held or Increased Bitcoin ETF Positions in Q2

Summary: U.S. institutional investors are increasingly supporting Bitcoin through spot ETFs, with a 30% rise in ETF filings and 66% of investors maintaining or increasing their holdings despite market volatility. Major institutions like Morgan Stanley and Goldman Sachs are expanding their Bitcoin ETF investments.

- Sentiment: 0.7

- CryptoPotato @ 2024-08-15 16:19:35 EDT Read More

Bitcoin and Ethereum ETF Gains Help BlackRock Flip Grayscale's Assets Tally

Summary: BlackRock has surpassed Grayscale Investments in assets under management for publicly-listed crypto products, including spot Bitcoin ETFs. This shift highlights the dominance of established ETF providers and the impact of distribution and expense ratios on market share.

- Sentiment: -0.3

- Decrypt @ 2024-08-15 16:17:38 EDT Read More

Institutional demand for crypto spiked in second quarter of 2024

Summary: Goldman Sachs has bet heavily on BlackRock’s iShares Bitcoin Trust, which has garnered significant institutional interest from Wall Street.

- Sentiment: 0.3

- TheStreet.com @ 2024-08-15 15:27:11 EDT Read More

Goldman Sachs jumps into bitcoin ETFs while rivals retreat, and one hedge fund gets bullish on miners

Summary: Goldman Sachs entered the spot bitcoin ETF market in Q2 2024, purchasing $418 million worth of bitcoin funds. Its largest investment was in BlackRock's iShares Bitcoin Trust, reflecting increased institutional interest in bitcoin ETFs since the SEC's January approval.

- Sentiment: 0.2

- NBC New York @ 2024-08-15 10:35:48 EDT Read More

US spot Bitcoin ETFs record net outflows worth $81 million, ending a two-day streak

Summary: US Bitcoin ETFs experienced significant outflows totaling $81.36 million on Wednesday, ending a two-day inflow streak. The Grayscale Bitcoin ETF saw the largest outflows, $56.87 million, contrasting with BlackRock’s iShares Bitcoin Trust ETF which recorded modest inflows.

- Sentiment: -0.27

- Cryptopolitan @ 2024-08-15 16:35:09 EDT Read More

Bitcoin ETF on Warren Buffett's Radar? Nate Geraci Says Bring It On By U.Today

Summary: Warren Buffett's Berkshire Hathaway recently restructured its portfolio, reducing investments in tech and finance while increasing holdings in other sectors. Despite Buffett's skepticism toward Bitcoin, his firm has invested in Nu Holdings, a fintech company involved in cryptocurrency services.

- Sentiment: 0.1

- Investing.com Australia @ 2024-08-15 09:00:00 EDT Read More

Fidelity Bitcoin ETF Sees $16.2 Million Daily Flow

Summary: Fidelity's Bitcoin ETF is experiencing significant interest, with $16.2 million in daily flows. This trend is vital for traders, as it impacts market sentiment and potential price movements of Bitcoin.

- Sentiment: 0.2

- Blockchain News @ 2024-08-15 20:49:32 EDT Read More

Two-Third of Institutional Bitcoin ETF Holders Increased or Held Positions in Q2

Summary: In Q2 2024, institutional investors showed increased confidence in spot Bitcoin ETFs, with 66% either increasing or maintaining their positions despite Bitcoin’s 5% decline in value. This trend reflects strong institutional support for Bitcoin ETFs amidst market volatility.

- Sentiment: 0.6

- The Tech Report @ 2024-08-15 19:33:29 EDT Read More

Wisconsin Investment Board Adds 447,000 shares to BlackRock Bitcoin ETF holdings

Summary: The State of Wisconsin Investment Board has shifted its investment from Grayscale’s Bitcoin Trust to BlackRock’s iShares Bitcoin Trust. This move, involving nearly $100 million, highlights growing institutional confidence in Bitcoin, favoring direct exposure through spot ETFs.

- Sentiment: 0.6

- deythere @ 2024-08-15 13:10:20 EDT Read More

Bitcoin Sell Pressure Intensifies Noted

2024-08-15 00:04:05 EDT, Sentiment: 0.57

Bitcoin’s bull rally is predicted to continue for 350 days with a $100,000 target, despite recent sell pressures.

Bitcoin Repayments Near Completion as BitGo Moves $2B from Mt. Gox

Summary: BitGo's recent transfer of 33,105 Bitcoin (BTC) is a major step in the Mt. Gox repayment process, bringing the total closer to settling $9 billion owed to creditors. The distribution's timing could impact Bitcoin's market volatility.

- Sentiment: 0.5

- deythere @ 2024-08-15 00:30:34 EDT Read More

Fed rate cuts are not a sure thing — What does this mean for Bitcoin?

Summary: The Federal Reserve may not cut interest rates as much as anticipated, potentially impacting Bitcoin’s price. Bitcoin recently fell below $60,000 amid speculation of rate cuts. The broader crypto industry remains hopeful that a rate cut could boost Bitcoin’s value.

- Sentiment: 0.1

- Cointelegraph @ 2024-08-15 00:10:50 EDT Read More

Bitcoin’s Bull Rally Predicted to Continue for 350 Days as $100,000 Target Looms: Bybit Analysis

Summary: Bitcoin's bull rally is expected to last another 350 days, potentially driving its price toward $100,000 by the end of 2024, according to Bybit's analysis. The rally's continuation is predicted based on historical price cycles and current investment trends.

- Sentiment: 0.8

- TOKENPOST @ 2024-08-15 00:04:05 EDT Read More

$1.7B in Dormant Bitcoin Moves, Raising Concerns Over Potential Sell Pressure

Summary: Recent movement of over $1.7 billion in long-dormant Bitcoin has sparked market speculation. Analysts warn it may indicate increased sell pressure, potentially driving prices down, though others suggest Bitcoin could recover due to improving market conditions.

- Sentiment: 0.05

- deythere @ 2024-08-15 10:30:53 EDT Read More

Stablecoin Supply Growth Isn't Eating Into Crypto Market Share: JPMorgan

Summary: The report highlights that the increase in Bitcoin (BTC) and Ether (ETH) prices this year has contributed to a higher total cryptocurrency market cap. However, the market share of stablecoins relative to this total has remained stable, despite their overall growth.

- Sentiment: 0.1

- CoinDesk @ 2024-08-15 10:09:21 EDT Read More

Crypto hacks double to $1.6bn as prices jump, report shows

Summary: In the first seven months of 2024, the value of crypto stolen surged to $1.6 billion, with Bitcoin accounting for 40% of this. The increase is partly due to Bitcoin's rising value, driven by new ETF offerings.

- Sentiment: -0.2

- Moneyweb @ 2024-08-15 09:46:41 EDT Read More

Bitcoin Sell Pressure Intensifies: Will $56K Support Hold as Options Expiry Approaches?

Summary: As Bitcoin options worth $1.4 billion near expiration, selling pressure could push its price below the critical $56,000 support level. This could trigger increased market volatility and further downward movement in Bitcoin’s price.

- Sentiment: -0.3

- EconoTimes @ 2024-08-15 11:42:01 EDT Read More

Bitcoin Sell Pressure Intensifies: Will $56K Support Hold as Options Expiry Approaches?

Summary: As $1.4 billion worth of Bitcoin options approach expiration, selling pressure could push Bitcoin's price below the critical $56,000 support level, heightening market volatility. Bitcoin's price is currently at $58,101, with a potential drop if it fails to surpass $60,000.

- Sentiment: -0.45

- EconoTimes @ 2024-08-15 11:42:01 EDT Read More

Bitcoin Down 10% In August—Here's What Traders Expect For September

Summary: Bitcoin (BTC/USD) has dropped 7% over the past 30 days, with predictions of further declines in September. A bearish cross on the daily chart signals short-term weakness, while institutional investment continues to grow, highlighting Bitcoin's evolving role as an asset class.

- Sentiment: -0.3

- Benzinga.com @ 2024-08-15 11:52:58 EDT Read More

Bitcoin Investors Hold Firm as CPI Data Looms: What It Means for the Market

Summary: Investors are increasingly accumulating Bitcoin in anticipation of the upcoming U.S. Consumer Price Index (CPI) data. This trend, driven by optimism about potential positive CPI results and institutional interest, suggests growing confidence in Bitcoin's role as an inflation hedge.

- Sentiment: 0.75

- The Currency analytics @ 2024-08-15 16:12:06 EDT Read More

Bitcoin, Ethereum, Dogecoin Continue Chaotic Ups And Downs, Trader Hopes It's The 'Final Weeks Of Pain'

Summary: Bitcoin's long liquidations have surged to their highest since August 5, amid a broader decline in crypto markets. Bitcoin's large transaction volume increased, while active addresses dropped. Analysts suggest Bitcoin could rebound, with predictions for a rise to around $56,280.

- Sentiment: -0.3

- Benzinga @ 2024-08-15 16:06:40 EDT Read More

Long-Term Bitcoin Holders Accumulate Over $22,058,146,000 in BTC Over the Past Three Months, According to Glassnode

Summary: Long-term Bitcoin holders have accumulated over $22 billion worth of BTC in the past three months, reflecting strong market fundamentals and a trend toward increased accumulation. This shift suggests potential for a new all-time high in Bitcoin's price.

- Sentiment: 0.8

- The Daily Hodl @ 2024-08-15 16:01:10 EDT Read More

Bitcoin ETF Options Face Setback as NYSE Abandons Listing Plan

Summary: NYSE American LLC has withdrawn its proposal to list Bitcoin ETF options, highlighting ongoing regulatory delays by the SEC. This adds uncertainty to the approval of Bitcoin-related financial products in the US, affecting investor risk mitigation strategies.

- Sentiment: -0.4

- EconoTimes @ 2024-08-15 15:13:58 EDT Read More

Gold Crashes, Bitcoin Rockets, And Peter Schiff Is Not Happy About It By U.Today

Summary: Bitcoin (BTC) and other riskier assets surged in response to lower-than-expected U.S. inflation data, which shifted market sentiment toward potential interest rate cuts. This contrasts with a sharp sell-off in gold, as BTC benefits from economic optimism.

- Sentiment: 0.1

- Investing.com Canada @ 2024-08-15 11:57:00 EDT Read More

These Coins Have Outperformed Bitcoin Despite a Delayed Altcoin Season

Summary: Bitcoin's dominance in the market is currently at 57.03%, up from a recent peak of 57.73%. This increased dominance has delayed the anticipated Altcoin Season, as most altcoins struggle to outperform Bitcoin and experience limited growth.

- Sentiment: -0.4

- BeInCrypto @ 2024-08-15 20:55:00 EDT Read More

Crucial Bullish Signal For Bitcoin Flashes For First Time Since 2023, Analyst Forecasts Major Rally

Summary: Ronaldo has deeply explored the crypto space, focusing on technical analysis of BTC charts to uncover market patterns and make informed investment decisions. His expertise aids in navigating the volatile market, while he also shares insights to help others in the crypto industry.

- Sentiment: 0.9

- NewsBTC @ 2024-08-15 20:00:45 EDT Read More

Nasdaq ISE pulls back on Bitcoin and Ethereum options trading

Summary: Nasdaq ISE and other exchanges have withdrawn proposals to trade options on Bitcoin ETFs due to lack of comments and regulatory uncertainty. Despite these withdrawals, refilings are anticipated as the SEC continues to review such proposals.

- Sentiment: -0.2

- Crypto Briefing @ 2024-08-15 20:00:43 EDT Read More

Crypto Analyst Says ‘Mother of All Squeezes’ Incoming for Altcoin That’s Currently Outperforming Bitcoin

Summary: The article highlights that GMX, a decentralized exchange token, is outperforming Bitcoin (BTC) due to a new profit distribution mechanism that will create significant buy pressure. Despite a recent drop, GMX has risen over 43% in the past week.

- Sentiment: 0.8

- The Daily Hodl @ 2024-08-15 20:49:33 EDT Read More

Data Shows Crypto Bear Market May Be a Distant Threat

Summary: Concerns are growing that the crypto market, including Bitcoin (BTC), may enter a bear phase due to recent price declines and market psychology indicators. BTC’s price drop, along with metrics like Net Unrealized Profit/Loss (NUPL), suggests a potential downturn.

- Sentiment: -0.6

- https//beincrypto.com @ 2024-08-15 19:45:00 EDT Read More

Bitcoin Trapped in Tight Range Amidst Uncertain Market Conditions

Summary: Bitcoin (BTC) has faced price consolidation due to weak spot demand and technical barriers, notably the 50-day SMA resistance. The upcoming options expiry and macroeconomic factors further complicate its outlook, with potential for a sell-off if conditions worsen.

- Sentiment: -0.6

- FXLeaders @ 2024-08-15 22:38:31 EDT Read More

$1.86 Billion in Bitcoin and Ethereum Options Set to Expire Amid CPI Fallout

Summary: Bitcoin options worth $1.4 billion are set to expire with a maximum pain point of $59,500, amidst heightened volatility due to lower US CPI data. This could lead to significant price swings and market adjustments for Bitcoin.

- Sentiment: 0.1

- BeInCrypto @ 2024-08-15 22:18:35 EDT Read More

Bitcoin’s (BTC) Price Rally to $68,000 Could Have Been a Dead Cat Bounce

Summary: Bitcoin's price recently dropped from $68,000 but remains stable due to strong investor confidence, particularly among large holders. The increase in Bitcoin’s Mean Coin Age suggests that investors are HODLing, which supports a potential price rise to $65,200.

- Sentiment: 0.5

- BeInCrypto @ 2024-08-15 21:45:00 EDT Read More

Technical Analysts Predicts a 9% Increase for Bitcoin and 1700% Surge For MoonTaurus in August 2024

Summary: In August 2024, Bitcoin is expected to grow by 9%, bolstered by institutional adoption and ETF potential. However, MoonTaurus (MNTR) is forecasted to surge by 1700%, attracting investors seeking higher returns due to its innovative tokenomics and strong community support.

- Sentiment: 0.7

- Impacts @ 2024-08-15 22:00:28 EDT Read More

Bitcoin’s (BTC) Price Rally to $68,000 Could Have Been a Dead Cat Bounce

Summary: Bitcoin’s price recently dropped from $68,000 but remains resilient due to investor confidence, particularly among whale investors. Despite volatility, rising Mean Coin Age suggests ongoing HODLing, indicating stability and potential for future gains if key support levels hold.

- Sentiment: 0.4

- https//beincrypto.com @ 2024-08-15 21:45:00 EDT Read More

Marathon Digital Acquires Large Bitcoin Holdings

2024-08-15 00:04:05 EDT, Sentiment: 0.65

Marathon Digital acquires 4,144 Bitcoins through a $300 million convertible note offering.

Marathon Digital Acquires 4,144 Bitcoins With $300M Convertible Note Offering

Summary: Marathon Digital bought 4,144 Bitcoins for $249 million from August 12 to 14, 2024, using proceeds from its $300 million convertible notes. This move aligns with their strategy to leverage market conditions and bolster their BTC holdings.

- Sentiment: 0.2

- CoinGape @ 2024-08-15 00:27:07 EDT Read More

Marathon Digital Buys $249M in Bitcoin After $300M Note Sale

Summary: Marathon Digital Holdings has acquired 4,144 Bitcoins, increasing its reserve to over 25,000 BTC. This purchase was funded by issuing $300 million in senior notes. Despite this, Marathon's stock has dropped significantly, and mining remains challenging due to recent Bitcoin halving.

- Sentiment: 0.1

- The Crypto Times @ 2024-08-15 00:04:05 EDT Read More

Marathon Digital snags more BTC after shift to ‘full HODL approach’

Summary: Marathon Digital bought 4,144 BTC for $249 million between August 12 and 14, continuing its "full HODL approach" and increasing its total BTC holdings to approximately 25,000. The acquisition aligns with its strategy to retain and periodically purchase bitcoin.

- Sentiment: 0.2

- Blockworks @ 2024-08-15 10:23:20 EDT Read More

Marathon Digital Holdings Acquires $249 Million in Bitcoin

Summary: Marathon Digital Holdings expanded its Bitcoin holdings with a $249 million purchase, increasing its total to over 25,000 Bitcoin, valued at $1.5 billion. This move aligns with a strategy of long-term accumulation, mirroring approaches of firms like MicroStrategy.

- Sentiment: 0.5

- The BTC Times @ 2024-08-15 11:18:41 EDT Read More

Marathon Digital’s $249M BTC Buy: What Next for Bitcoin Price?

Summary: Marathon Digital Holdings invested $249 million to acquire 4,144 BTC between August 12 and August 14, reflecting its confidence in Bitcoin's long-term value despite current market volatility. The acquisition, averaging $59,500 per Bitcoin, signals a strategic move amid price fluctuations.

- Sentiment: 0.2

- The Coin Republic @ 2024-08-15 11:11:56 EDT Read More

Bitcoin Miners Show Renewed Confidence as Marathon Digital Increases Reserves

Summary: Marathon Digital acquired $249 million in Bitcoin, increasing its reserves to over 25,000 BTC, following a $300 million senior note offering. This move highlights its strategic focus on Bitcoin as a key asset amid market volatility and mining challenges.

- Sentiment: 0.65

- The Cryptocurrency Post @ 2024-08-15 11:11:33 EDT Read More

Marathon Digital Reveals Purchase of 4,144 BTC and $300 Million Note Offering

Summary: Marathon Digital Holdings acquired 4,144 Bitcoin tokens for approximately $250 million, financed through a convertible note offering. This move underscores their strategy to bolster Bitcoin reserves and solidify their position as a major corporate Bitcoin holder despite market volatility.

- Sentiment: 0.3

- The Tech Report @ 2024-08-15 20:30:34 EDT Read More

Bitcoin crash bottom level revealed

2024-08-15 00:00:01 EDT, Sentiment: 0.62

The message highlights Bitcoin's recent crash and ongoing discussions about its future, including investment and regulatory impacts.

This Is The On-Chain Level That Made The Bitcoin Crash Bottom

Summary: The article does not address Bitcoin or any related topics.

- Sentiment: 0.8

- NewsBTC @ 2024-08-15 00:00:01 EDT Read More

5 Most Visited Cryptocurrencies in 2024: BlockDAG, Bitcoin, Ethereum & More

Summary: Bitcoin remains the largest cryptocurrency with a finite supply of 21 million coins, providing a stable store of value and boasting the most secure network and user base. It continues to lead as a prominent player in the crypto market.

- Sentiment: 0.7

- Impacts @ 2024-08-15 00:44:49 EDT Read More

Arthur Hayes: Why Bitcoin Ordinals Project Airhead Isn't Another ‘Boring’ NFT Drop

Summary: BitMEX co-founder Arthur Hayes is launching a Bitcoin Ordinals collection called Airhead, featuring 10,000 unique NFT-like assets. This initiative aims to offer a novel form of Bitcoin-based digital art, enhancing the functionality and appeal of Bitcoin collectibles.

- Sentiment: 0.1

- Decrypt @ 2024-08-15 10:31:07 EDT Read More

Why are Your Grandma and Little Brother Buying Bitcoin?

Summary: The article highlights how rising skepticism towards traditional investments is driving diverse age groups, including younger generations and retirees, towards cryptocurrencies like Bitcoin. This shift reflects a growing preference for decentralized assets over conventional financial options.

- Sentiment: 0.5

- HackerNoon @ 2024-08-15 10:27:20 EDT Read More

Resistance Builds Against The Warren "Anti-Crypto" Agenda

Summary: Senator Elizabeth Warren's anti-crypto stance, which includes strict regulations on Bitcoin, is facing backlash. Her proposals have drawn criticism from both Republicans and pro-Bitcoin Democrats, signaling a shift in American political attitudes towards Bitcoin and cryptocurrency regulation.

- Sentiment: -0.3

- Forbes @ 2024-08-15 11:14:56 EDT Read More

Bitcoin Dogs to list on three notable exchanges on August 21

Summary: Bitcoin Dogs, a meme coin, will list on Gate, MEXC, and Unisat on August 21. This broad exchange listing, along with its ICO status on the Bitcoin blockchain, is expected to boost the coin's visibility and price significantly.

- Sentiment: 0.8

- Invezz @ 2024-08-15 10:39:56 EDT Read More

Bitcoin Gift Card - Win Bitcoin and Other Cryptocurrencies at Blu J, North ⟋ RA

Summary: In the ever-evolving world of digital finance, Bitcoin remains one of the most popular and widely recognized cryptocurrencies. As Bitcoin continues to gain...

- Sentiment: 0.0

- Resident Advisor @ 2024-08-15 16:19:10 EDT Read More

Bitcoin Millionaire on Investment Tips, Anonymity and Crypto's Role in Politics

Summary: The CoinDesk Bitcoin Price Index (XBX) is a leading benchmark for bitcoin pricing, trusted by major institutions for financial products and transactions. Operating since 2014, XBX ensures replicability and reliability in the crypto market.

- Sentiment: 0.1

- CoinDesk @ 2024-08-15 16:02:10 EDT Read More

Chinese investors find new ways to engage in digital assets market

Summary: Chinese investors are bypassing strict government bans on cryptocurrency by utilizing VPNs and peer-to-peer platforms like OKX and Binance. Despite China's prohibitions on trading and mining, the country remains a significant player in Bitcoin mining, showcasing resilience and adaptability.

- Sentiment: 0.1

- financial-world @ 2024-08-15 16:00:17 EDT Read More

Top 5 Cryptos to Buy Right Now – BlockDAG, Bitcoin, Dogecoin, ADA, and Ethereum

Summary: Bitcoin (BTC) remains a dominant force in the cryptocurrency market, bolstered by innovations like the U.S. spot Bitcoin ETFs and legal tender acceptance. Its reliable growth potential and strong institutional support make it a key investment for substantial returns.

- Sentiment: 0.8

- Impacts @ 2024-08-15 15:30:02 EDT Read More

Bitcoin advocate rebuts IMF Report on crypto carbon emissions

Summary: Bitcoin advocate Daniel Batten has rebutted an IMF report suggesting a crypto carbon tax due to Bitcoin's environmental impact. Batten criticized the report for using outdated data and flawed comparisons, asserting that Bitcoin mining has a net decarbonizing effect.

- Sentiment: 0.2

- crypto.news @ 2024-08-15 16:45:00 EDT Read More

Senate Majority Leader: Bipartisan Crypto Legislation Could Pass in 2024

Summary: Senate Majority Leader Chuck Schumer is optimistic about passing bipartisan crypto legislation by year's end.

- Sentiment: 0.0

- Bitcoin.com News @ 2024-08-15 20:49:32 EDT Read More

Ministers, Central Bank Discuss ‘Creating Russian Crypto Exchanges’

Summary: Russia is considering creating legal crypto exchanges as part of its shift towards cryptoassets, with legislation potentially introduced in the State Duma's fall session. This move follows recent laws allowing Bitcoin mining and its use for international transactions.

- Sentiment: 0.3

- cryptonews @ 2024-08-15 19:30:00 EDT Read More

Iran Escalates Crackdown on Illegal Crypto Mining Amid Severe Power Crisis

Summary: Iran is aggressively cracking down on illegal cryptocurrency mining as the nation faces a severe power crisis.

- Sentiment: 0.0

- Bitcoin.com News @ 2024-08-15 21:47:31 EDT Read More

Bitcoin price fluctuates, drops below $58K.

2024-08-14 23:41:06 EDT, Sentiment: 0.41

Bitcoin's price is currently struggling and has dropped below $58,000, with forecasts predicting a potential crash to $50,000 or lower.

Is Bitcoin (BTC) Price Heading for $70K Breakout or $40K Crash?

Summary: Bitcoin (BTC) fell 4% to around $58,413, facing resistance at $61k-$62k and potential further decline due to a death-cross between 50 and 200 MAs. Increased whale activity and upcoming U.S. elections could impact BTC's price direction.

- Sentiment: -0.4

- Coinpedia @ 2024-08-15 00:27:50 EDT Read More

Bitcoin price (BTCUSD) forms negative pattern – Forecast today - 15-08-2024

Summary: The article indicates that Bitcoin (BTC) has ended below $60,326.70, showing a bearish trend with potential to decline further to around $51,990.00. The price could rebound if it breaches $60,326.70, otherwise, a continued downtrend is expected.

- Sentiment: -0.6

- Economies.com @ 2024-08-15 00:04:05 EDT Read More

Crypto traders flock to Poodlana as Bitcoin remains below $60k

Summary: Bitcoin's value dropped to $58,000 as it and other cryptocurrencies lagged behind the stock market, despite a favorable US inflation report. Investors are shifting focus to the new meme coin Poodlana, which has seen significant demand and investment.

- Sentiment: -0.2

- Invezz @ 2024-08-14 23:41:06 EDT Read More

Bitcoin price today: down to $58k as Mt Gox fears offset CPI cheer

Summary: Bitcoin's price dropped nearly 4% to $58,467 due to fears of additional selling pressure from Mt Gox's upcoming token distributions and significant outflows from crypto exchanges. These factors overshadowed positive U.S. inflation signals and broader market rallies.

- Sentiment: -0.5

- Investing.com @ 2024-08-15 02:01:24 EDT Read More

Bitcoin Price Crash to $20,000 Anticipated by Crypto Analyst

Summary: A crypto analyst suggests Bitcoin may eventually fall back to $20,000, highlighting resistance patterns seen in past market cycles. The analysis points to the Stochastic RSI as a key indicator of potential price declines, though this scenario might take months to develop.

- Sentiment: 0.0

- West Island Blog @ 2024-08-15 01:47:52 EDT Read More

Bitcoin Struggles Under $60K as Critical Resistance Unleashes Downward Trend

Summary: Bitcoin's price recently fell back to $58,000 after failing to surpass the $61,500 resistance. With key support levels at $58,000 and $57,650, and resistance near $58,800 and $59,500, Bitcoin faces potential further declines if it can't break above these resistance points.

- Sentiment: -0.6

- West Island Blog @ 2024-08-15 01:45:33 EDT Read More

Bitcoin Dominance Dips to 55%: Are Altcoins Ready to Take Over

Summary: In August, Bitcoin's price dropped from above $60,000 to a low of $49,000, impacting its market dominance, which fell to about 53% before partially recovering to 55%. This decline has shifted focus towards altcoins, though Bitcoin remains influential.

- Sentiment: -0.3

- The Currency analytics @ 2024-08-15 01:32:09 EDT Read More

Cryptocurrency Price Today (August 15): Bitcoin Dipped Down To $58,000, ORDI Becomes Biggest Loser

Summary: Bitcoin (BTC) surpassed $60,000 but recently fell to $58,320.46, showing a 24-hour dip of 4.47%. Despite this drop, BTC remains the top-valued cryptocurrency amidst a generally neutral market sentiment.

- Sentiment: 0.1

- ABP Live @ 2024-08-15 01:30:24 EDT Read More

Bitcoin (BTC) Prediction for August 15

Summary: Bitcoin (BTC) has dropped 3.06% in the last 24 hours, trading at $59,320. Despite recent declines, if it closes above $59,021, it might test the $60,000 range. Currently, sideways trading between $58,000 and $60,000 is expected.

- Sentiment: 0.1

- u.today @ 2024-08-15 10:47:00 EDT Read More

Bitcoin (BTC/USD) Price Holds Steady as Accumulation Trend Signals Potential Breakout

Summary: Bitcoin's price remains constrained between $58,500 and $61,600 due to market caution and a $594 million US government sale of confiscated Bitcoin. However, increasing accumulation by large wallets and a Double Bottom pattern suggest a potential bullish breakout.

- Sentiment: 0.15

- MarketPulse @ 2024-08-15 10:40:17 EDT Read More

Trading expert outlines Bitcoin’s path to $300,000

Summary: Following the U.S. Consumer Price Index release, Bitcoin (BTC) saw a sharp correction but analysts remain optimistic. Trading Shot projects Bitcoin could reach $200,000 to $300,000, supported by historical patterns and technical indicators like the bullish MACD cross.

- Sentiment: 0.7

- Finbold @ 2024-08-15 10:28:19 EDT Read More

Could Bitcoin surpass $100,000 as investor interest grows?

Summary: Bitcoin's future price trajectory remains a hot topic, with experts predicting it could eventually surpass $100,000 and even reach $225,000. Chris Sullivan highlights that a break past $100,000 could spur significant investor interest and market growth.

- Sentiment: 0.2

- YAHOO!Finance @ 2024-08-15 09:32:00 EDT Read More

Bitcoin price today: BTC is down 4.23%

Summary: Bitcoin is currently priced at $58,744.40. Its highest intraday price over the past year was $73,750.07 on March 14, 2024. Bitcoin’s all-time high remains $73,750.07, reflecting a 102% increase year over year.

- Sentiment: 0.3

- USA Today @ 2024-08-15 10:18:19 EDT Read More

Crypto Analyst Reveals The Condition That Will Drive The Bitcoin Price To $250,000

Summary: Crypto analyst Michaël van de Poppe predicts Bitcoin (BTC) could reach $250,000 if it closes around $60,000 monthly, marking a 300% gain. This surge would also boost ETFSwap (ETFS) to significant heights, with predictions of a 54,000% increase.

- Sentiment: 0.9

- Analytics Insight @ 2024-08-15 12:00:00 EDT Read More

Bitcoin Price Plunges Below $57k as U.S. Govt Transfers BTC Worth $600M

Summary: Bitcoin's price dropped 8% to $56,700 on August 15, largely due to U.S. government transactions involving 10,000 BTC from the Silk Road seizure. Historical patterns suggest such actions often lead to significant price declines, with Bitcoin now eyeing $55,000 support.

- Sentiment: -0.8

- FX Empire @ 2024-08-15 16:11:10 EDT Read More

Bitcoin (BTC) Plunges Again. Is $30K Possible?

Summary: Bitcoin recently saw high volatility, dropping to $57,002. Over $120 million in crypto was liquidated in 24 hours. Trader @Alejandro_XBT predicts a potential drop to $30,000, drawing comparisons to 2022’s market conditions. A significant event would be needed to reach this low.

- Sentiment: -0.5

- u.today @ 2024-08-15 15:56:25 EDT Read More

Bitcoin Price Crashes Below $57K as Total Liquidations Exceed $200 Million

Summary: Bitcoin's price has dropped 3.6% in the last 24 hours, falling below $57,000. The decline is linked to significant BTC movements from a US Government wallet and increased selling pressure, leading to over $200 million in liquidations.

- Sentiment: -0.4

- CryptoPotato @ 2024-08-15 16:01:34 EDT Read More

Analyst Says Bitcoin Primed To Crash Below $50,000 if Major Level Holds, Updates Outlook on Sui and Helium

Summary: Crypto analyst Altcoin Sherpa predicts Bitcoin (BTC) could drop below $50,000 if it fails to hold its current support level. He suggests that BTC might either surge to $70,000 or fall into the low $40,000s based on its price action.

- Sentiment: 0.02

- The Daily Hodl @ 2024-08-15 15:55:54 EDT Read More

Bitcoin stagnates as bearish headwinds continue to blow

Summary: Bitcoin (BTC) has struggled to break above $62,000 since August 8, with negative futures funding rates signaling low demand. Despite strong performances in traditional markets, Bitcoin's appeal is waning, highlighted by reduced stablecoin demand in China.

- Sentiment: -0.35

- CoinTelegraph @ 2024-08-15 18:15:00 EDT Read More

Bitcoin Drops Under $58,000 as Net Sell-Side Bias Persists

Summary: On Thursday, Bitcoin's price fell to $57,500, a 3% drop within an hour. This decline is partly attributed to fears over a potential large-scale BTC sale by the U.S. government and significant sell-side pressure in digital asset markets.

- Sentiment: -0.4

- Unchained Podcast @ 2024-08-15 21:03:51 EDT Read More